ARTICLE 24

SALARY

24.1 The salary schedule for bargaining unit employees shall be found in Appendix A and incorporated in this Agreement by reference.

Classifications will be grouped as specified in Appendix C. Between the minimum and maximum rates, there shall be an “open range” with no incremental salary steps. Pursuant to Appendix D-7, CSU and Teamsters Local 2010 agree to meet and discuss the viability of the implementation of a step process salary structure.

24.2 An employee shall be assigned to a rate within the salary range appropriate to his/her classification. New hires shall be assigned no less than the Minimum Rate appropriate to his/her classification.

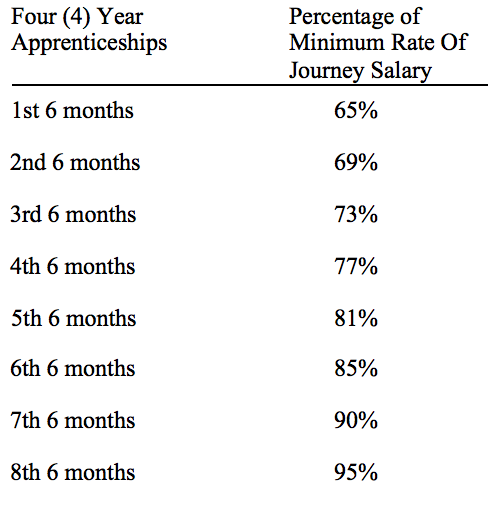

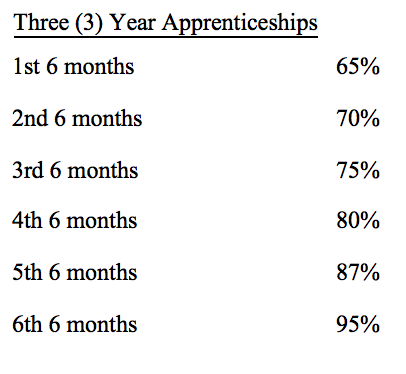

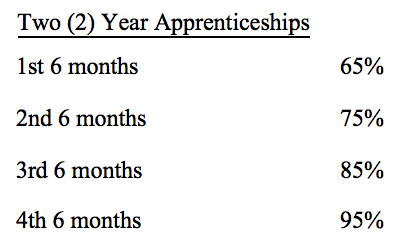

24.3 The schedule of wages for approved and registered apprenticeships shall be as follows:

a.

b.

c.

Provisions 24.5 through 24.9 below do not apply to employees in apprentice positions.

24.4

a. A General Salary Increase (GSI) is a percentage increase applied to the minimum and maximum rate on the new salary schedule for all bargaining unit classifications and to the individual salary rates of all bargaining unit members.

b. For Fiscal year 2017/18, effective on and after July 1, 2017, (i) all bargaining unit members in active pay status, or on leave, up to the date of ratification by the CSU Board of Trustees of this Agreement, shall have their individual salary rate increased by 3.11% (three and eleven one hundredth percent); and (ii) Salary scale maximums and minimums for all classifications shall be increased by the amount of the General Salary Increase.

c. For Fiscal year 2018/19,

i. Effective on or after July 1, 2018, all bargaining unit members in active pay status or on leave as of that date shall have their individual salary rate increased by 3%;

ii. Salary scale maximums and minimums for all classifications shall be increased by the amount of the General Salary Increases.

d. For Fiscal year 2019/20,

i. Effective on or after July 1, 2019, all bargaining unit members in active pay status or on leave as of that date shall have their individual salary rate increased by 3.75%;

ii. Salary scale maximums and minimums for all classifications shall be increased by the amount of the General Salary Increases.

24.5 An increase within a salary range that is not given for merit is referred to as an In-Range Progression. An In-Range Progression of at least 3% may be awarded when the president, the president’s designee, or appropriate administrator determines that an In-Range Progression should occur. Factors to be considered for granting such progressions shall include but not be limited to:

a. Long-term service;

b. Retention;

c. Equity;

d. Assigned application of enhanced skill(s);

e. Performance;

f. Out-of-classification work that does not warrant a reclassification;

g. Increased workload;

h. New lead work or new project coordination functions given to an employee on an on-going basis by an appropriate administrator where the classification standard/series do not specifically list lead work as a typical duty or responsibility; and,

i. Other salary related criteria

24.6 A request for an in-range progression review may be submitted by the employee or manager. A management-initiated request for an in-range progression may cover more than one employee. Employee initiated in range progression requests shall be submitted to the appropriate administrator before being forwarded to Human Resources. An employee shall not submit a request for an in-range progression prior to twelve (12) months following the receipt of a denial of a request for an in-range progression, or prior to 12 months from the effective date of an award of an in-range progression. If an administrator has not forwarded the request to Human Resources within thirty (30) days, the employee can file the request directly with Human Resources.

24.7 In-range progression review of employee requests shall be completed within ninety (90) days after the request is received in Human Resources. If an employee receives a denial of request for an In-range Progression under this Article, then the campus shall provide the employee with a written reason for the denial.

24.8 Each campus shall develop guidelines and procedures for an in-range progression consistent with this Article. Any changes to campus guidelines and procedures shall be noticed to Teamsters Local 2010 prior to implementation and be subject to the meet and confer process where the union subsequently requests to meet and confer over the proposed changes.

24.9 The decision of the President, made in accordance with this provision, regarding the award of an in-range progression shall be final and shall not be subject to Article 9 (Grievance Procedure).

24.10 The union may, within 30 days of the employee receiving written notification of the IRP denial, file an appeal to an Umpire selected by the parties for the purpose of hearing such appeals. The grounds for the appeal shall be strictly limited to whether or not the decision was made “in accordance with this provision” pursuant to Articles 24.9 and 24.11.

24.11 A decision is made “in accordance with this provision” if the procedural requirements of this Article have been complied with, and the decision itself is not arbitrary or capricious. The Umpire should not substitute the Umpire’s opinion for that of the President. A decision of the President should not be disturbed unless it is proved by the Appellate to have been made on an arbitrary or capricious basis. A decision is arbitrary and capricious only if it is made on unreasonable grounds, or without any proper consideration of the circumstances of the employee’s IRP request.

24.12 Within 30 days of ratification the parties shall select one arbitrator from the current arbitration panel to act as the Umpire for IRP appeals. If the parties are unable to agree on an Umpire, the Umpire shall be selected by strike from the names of arbitrators on the current panel who are willing to serve in this capacity. First strike shall be determined by the toss of a coin. The issue will be determined by the Umpire following the submission of written briefs, on a briefing schedule to be determined by the Umpire. There shall be no oral hearing. The Umpire’s decision shall be issued in writing within 21 days of the submission of the briefs, and shall set forth the Umpire’s findings, reasoning, and conclusions on the sole issue of whether or not the decision was made in “accordance with this provision” pursuant to Articles 24.9 and 24.11.

24.13 If the Umpire determines that the decision was not made “in accordance with this provision”, the application will be returned to the campus for reconsideration at the stage at which the error was made. The umpire shall have no authority to make any award other than an order to remit the IRP request back to the campus for them to reconsider following the Umpire’s written decision. The campus review will take place within 30 (thirty) days of the Umpire issuing the written decision.

24.14 The Umpire’s decision shall be final and binding.

24.15 The Umpire’s costs shall normally be shared equally by the parties, unless the Umpire makes a determination, on application of either party within 7 days of receiving the written decision, that there was no reasonable basis for either bringing, or defending, the Appeal. Having made that determination, the Umpire shall then order the full costs of the Appeal to be paid by the party against whom the determination was made.

24.16 Funds for in-range progression may come from campus funds, and/or total settlement costs resulting from bargaining between the parties on salary matters.

24.17 Within 60 days from the ratification of this Agreement, the CSU and Teamsters Local 2010 shall meet to negotiate systemwide procedures and criteria for in-range progressions consistent with this Article. In the event that the parties are unable to reach agreement on the procedure to be adopted and/or the criteria to be applied, then the issue(s) shall be submitted to the Umpire selected in 24.12 who will choose between the two proposals. The umpire shall have no authority to add or subtract from the proposals as submitted by the parties.

Performance-Based Salary Increase

24.18 Campuses may award salary increases for meritorious performance from campus funds at any time. These salary increases may be in the form of permanent increases to salary rates or one-time bonuses. However, in no case may an employee’s salary rate exceed the maximum of the range on the salary schedule for the employee’s range and classification. Such awards are solely at the discretion of the President and shall not be subject to the Grievance Procedure.

Extended Performance Increase (EPI)

24.19 An Extended Performance Increase (EPI) is a permanent increase to an employee’s base salary. It is the intent of the parties to bargain implementation of this program for each year during the life of this agreement. In the event the parties agree to fund the program – the specific amounts of both the size of the EPI pool and individual amounts of awards along with any associated implementation issues – will be determined through the collective bargaining process. However, in no case shall an employee receive any EPI award which would place their salary over the maximum salary rate for their classification. All EPIs awarded prior to July 1, 2004 shall remain in effect.

24.20 EPI Eligibility

a.To be eligible for an EPI, the employee’s overall performance must have been satisfactory for the previous three (3) years, as evidenced by an overall performance evaluation rating of satisfactory or better, and have no disciplinary actions received in the past three (3) years which remain in the personnel file.

b. In addition to these performance requirements, the employee must have completed an anniversary of continuous CSU employment at a fifty (50) percent or more timebase at the employee’s 3rd, 6th, 10th, 15th, 20th, 25th, 30th 35th, 40th, etc. years) of qualifying pay periods and qualifying months of service at the CSU, as defined in Articles 16, 18, and 19 and below in this provision. For the purposes of this provision, any month in which the employee was not in pay status for at least eleven (11) days in the pay period is considered a break in the continuous service requirement.

c. A year of required service for a ten (10) month or 10/12 employee is the completion of twelve (12) pay periods and ten (10) qualifying months of service. A year of required service for an eleven (11) month or 11/12 employee is the completion of twelve (12) pay periods and eleven (11) qualifying months of service. A year of required service for a twelve (12) month employee is the completion of twelve (12) pay periods and twelve (12) qualifying months of service.

d. Employees who believe they are eligible for an EPI based on service at another campus shall notify in writing the campus Human Resources Office of such service.

24.21 Upon determination by the appropriate administrator, the EPI shall be authorized in writing. Upon request of an employee denied an EPI, a meeting shall be arranged within seven (7) days of the request with a representative of the President for the purpose of reviewing such a denial. The employee may be represented at this meeting. The denial of an EPI shall not be subject to Article 9, Grievance Procedure. An employee who meets the service requirements for an EPI in accordance with provision 24.8 and is denied an EPI shall remain eligible for reconsideration on an annual basis, if EPIs are funded in subsequent years.

24.22 When an employee moves to a classification in a lower salary group, the appropriate rate in the salary range shall be determined by the President, except that in no case shall the new salary exceed the rate received in the higher classification or the maximum rate of the lower classification. Determination of the appropriate rate in such cases shall be made by using the same criteria as would be used for an initial appointment to that classification and by considering past PSIs, if any.

24.23 When an employee moves to a classification within a salary group, the appropriate rate in the new classification shall be determined by the President. There is no requirement to increase the employee’s rate of pay unless it is below the minimum of the new classification, in which case it must be increased to at least the minimum of the new classification.

24.24 When an employee moves without a break in service to a classification in a higher salary group, the appropriate rate in the salary range shall be determined by the President. The new rate in the higher salary group shall be at least five (5) percent higher than the employee’s previous rate, except that the new rate may not exceed the maximum of the range.

24.25 A payment above the maximum of the salary range for a class may be granted by the President when an employee moves to a class with a lower salary range.

24.26 If a payment above the maximum is granted, the employee shall retain either the salary currently being paid or a salary twenty-five (25) percent above the maximum salary of the lower class, whichever is less. The employee shall remain at that salary rate until the maximum salary of the lower class equals or exceeds the payment above the maximum rate or until the authorized time period for maintaining the payment above the maximum rate expires, whichever occurs first.

24.27 During the period of time an employee’s salary remains above the maximum salary for the class, the employee shall not receive further salary increases, including GSIs or PSIs, except in cases of promotion.

24.28 A payment above the maximum shall not exceed twenty-five (25) percent above the maximum of the salary range of the class to which the employee is moving. An employee may retain a payment above the maximum for up to five (5) years.

24.29 Payment above maximum shall not be authorized for an employee when:

a. an employee, for personal convenience, requests voluntary demotion;

b. an employee is demoted for cause other than for medical.

24.30 An employee who was compensated at a salary rate above the maximum prior to a permanent separation will not be entitled to a payment above the maximum upon his/her return to work. Also, the authorization for a payment above the maximum shall be canceled if the employee refuses an offer of appointment to a position at the campus in a class at a salary level equivalent to the original classes from which the employee was moved.

Cost Savings/Staffing Committee

24.31 A cost savings/staffing committee shall include an equal number of employee representatives and management/supervisory representatives. The cost savings/staffing committee shall meet no less than twice per year. The cost savings/staffing committee shall submit recommendations to the appropriate administrator and president for economy measures and staffing issues. The committee may also recommend specific uses for any cost savings. The committee may choose to discuss economies associated with training, maintenance and repair, new technologies, and funding opportunities related to bargaining unit work.

24.32 There are three (3) shifts: day, swing, and graveyard. The day shift includes the hours between 6:00 a.m. to 6:00 p.m. The swing shift includes the hours between 6:00 p.m. and midnight. The graveyard shift includes the hours between midnight and 6:00 a.m.

24.33 Employees who work four (4) or more hours in the swing shift shall be paid a shift differential of one dollar and thirty cents ($1.30) per hour for the employee’s entire shift.

24.34 Employees who work four (4) or more hours in the graveyard shift shall be paid a shift differential of two dollars and thirty cents ($2.30) per hour for the employee’s entire shift.

24.35 To receive a shift differential, an employee must be assigned hours of work of which at least four (4) hours are within a regularly scheduled swing or graveyard shift.

24.36 Employees who are regularly scheduled to work on Sundays shall receive a differential equal to the swing shift differential. The Sunday pay differential shall not be added to or combined with any other pay differential or premium pay.

Asbestos and Hazardous Material Handling Pay Differential

24.37 Whenever an employee is assigned to perform any asbestos-related or hazardous material handling duties including but not limited to removing or repairing asbestos lagging, performing any asbestos abatement or cleaning up asbestos, he/she shall be paid an asbestos pay differential of three dollars ($3.00) per hour for the amount of time spent performing such work. “Hazardous material handling duties” as used in this provision refers to work that a) requires by law the employee be trained and certified to work with the specified material, and b) requires the employee use protective equipment and extra precautions to ensure his/her safety and health.

Asbestos Training and Hazardous Material Handling Certification Allowance

24.38 Employees who have been required by the CSU to undergo training in either asbestos abatement and handling or in hazardous materials handling as defined in 24.37 shall be paid an allowance of two hundred and fifty dollars ($250). Payment shall be made within thirty (30) days after the demonstrated completion of such training and the certification, if required, for the performance of such work.

24.39 Employees who have been required by the CSU to undergo training in order to maintain or renew the certifications described in provision 24.38 above shall be paid an allowance of two hundred and fifty dollars ($250). Payment shall be made within thirty (30) days after the demonstrated completion of such training and the subsequent renewal of such certification.

24.40 For the purpose of provisions 24.38 and 24.39 above, training in either asbestos abatement and handling or in hazardous materials handling must be either EPA-certified or CAL-OSHA approved.

Backflow Testing and Water Treatment Operator Allowances

24.41 Employees who are required by the CSU to obtain either a backflow testing license or the appropriate water treatment operator certificate shall be paid an allowance of two hundred and fifty dollars ($250). Payment shall be made within thirty (30) days after the employee has demonstrated that he/she has obtained the license or certificate.

24.42 Employees who are required by the CSU to renew their license or certificate described in provision 24.41 above, shall be paid an allowance of two hundred and fifty dollars ($250). Payment shall be made within thirty (30) days after the employee has demonstrated that he/she has renewed the license or certificate.

24.43 Employees who are required by the CSU to obtain a Welding Certification shall be paid an allowance of two hundred and fifty dollars ($250). Payment shall be made within thirty (30) days after the employee has demonstrated that he/she has obtained the license or certificate.

24.44 Employees who are required by the CSU to renew their license or certificate described in provision 24.43 above, shall be paid an allowance of two hundred and fifty dollars ($250). Payment shall be made within thirty (30) days after the employee has demonstrated that he/she has renewed the license or certificate.

24.45 Qualified high voltage electricians approved by the Director of Plant Operations or appropriate administrator shall be paid an annual stipend of four hundred and fifty dollars ($450.00).

24.46 A qualified high voltage electrician for the purposes of this Agreement is a person who has:

a. a minimum of two years of electrical training and experience with high voltage electrical infrastructure designed to operate over 600 volts;

b. demonstrated by performance familiarity with the work to be performed and the hazards involved; and

c. successfully completed the following training by an authorized OSHA Training Institute (OTI) Education Center:

1. Core Safety Training;

2. Advanced Electrical Safety and Lockout/Tagout training; and

3. Hazardous Electrical High Voltage training.

24.47 Payment shall be made within thirty (30) days after the CSU/appropriate administrator Director of Plant Operations or Appropriate Administrator has evaluated and determined that the employee has demonstrated that he/she is a qualified high voltage electrician.

24.48 The decision whether to request employees to obtain certification and training as a qualified high voltage electrician is at the sole discretion of the CSU and is thus neither grievable nor arbitrable. Where the CSU requires such certification and training, the CSU will pay for the OTI training.

24.49 An employee shall be paid an initial one-time bonus of five hundred dollars ($500) when he/she is asked by the Director of Plant Operations or the Appropriate Administrator to complete and obtain one of the following recognized certifications:

- California State Certified Electrician

- Certified Building Operator

- Certified Steam Operator/Universal Steam Certification

- ASE Master Technician status at Automobile, Medium-Heavy Truck, School Bus or Transit Bus.

The certification must be from a CSU preapproved training program to be determined by the parties, such as the following:

a. Certified Electrician – OSHA Training Institute or another agency preapproved by the CSU

b. Certified Building Operator – Building Operator Certification or another agency preapproved by the CSU

c. Certified Steam Operator/Universal Steam Certification

d. ASE Master Technician status at Automobile, Medium-Heavy Truck, School Bus or Transit Bus – National Institute for Automotive Service Excellence

24.50 The decision whether to request employees to obtain or renew such a certification is at the sole discretion of the CSU and is thus neither grievable nor arbitrable. Where the CSU requires such certification and training, the CSU will pay for the training.

24.51 Payment for the initial certification and any and all renewal certifications thereafter shall be made within thirty (30) days after the Director of Plant Operations or appropriate administrator has evaluated and determined that the employee received or renewed the certification from a preapproved training program.

24.52 Employees who are required by the CSU to renew a certification as described in provision 24.49, above, shall be paid a bonus of two hundred and fifty dollars ($250).

24.53 When the President determines it is necessary to close the campus because of an emergency situation or condition and other employees are sent home on paid administrative leave, an employee that volunteers, is asked or is assigned by the appropriate administrator to continue working at the campus where the emergency exists, shall receive “Emergency Pay.”

a. The term “emergency” as used in this provision means a sudden, unexpected happening; an unforeseen occurrence or condition requiring immediate action, including, but not limited to a natural disaster, act of terrorism, or threat to campus health, safety or property.

b. “Emergency Pay” is compensation for the hours worked by the designated employees during their normal shift while the campus is closed during the administrative leave period.

c. “Emergency Pay” is a premium payment (exclusive of the employee’s regular pay), paid at one times the employee’s straight time rate of pay for each hour worked during the emergency when the campus is on administrative leave. At the discretion of management, emergency pay may be awarded as cash or CTO. If paid as cash, the payment must be paid at the employee’s straight time rate. If credited as CTO, the hours credited must be on a straight time basis.

d. Time worked while receiving “Emergency Pay” are regular hours worked during their normal shift within the forty (40) hour workweek period.

e. The emergency pay premium will also be paid for any hours worked on an overtime basis during the emergency when the campus is on administrative leave.

f. Premium pay received as emergency pay for hours worked during the employee’s regular shift and when on an overtime basis shall be includable compensation for the purposes of determining the regular rate of pay for the payment of overtime.

g. Employees on paid time off (i.e., Sick Leave, Vacation, Personal Holiday) when the emergency is declared who are not called back to work shall remain on such paid time off status and will not receive administrative leave pay or emergency pay.

24.54 Probationary and permanent employees shall be eligible to request participation in the 10/12 or 11/12 pay plan.

24.55 The assignment of an eligible employee into the 10/12 or 11/12 pay plan and the yearly schedule shall be by mutual agreement of the appropriate administrator and the employee. Final approval by the President is required prior to employee participation in the 10/12 or 11/12 pay plan.

24.56 Withdrawal from participation in the 10/12 or 11/12 pay plan and return to a twelve (12) month annual work year may be requested by an employee in accordance with campus procedures. When operational needs require, the appropriate administrator may request an employee on the 10/12 or 11/12 work plan return to a twelve (12) month annual work year. In both instances, the employee and appropriate administrator shall attempt to reach mutual agreement regarding the request. In the absence of mutual agreement, the President shall make a final determination, provided that an employee be given at least twelve (12) months notice of his/her return to a twelve (12) month annual work year.

24.57 An employee participating in the 10/12 or 11/12 pay plan shall receive his/her (10-month or 11-month) annual salary in twelve (12) salary warrants and appropriate benefits on a twelve (12) month basis.

24.58 An employee moving from a twelve (12) month status to the 10/12 or 11/12 pay plan shall retain his/her salary anniversary date.

24.59 An employee on the 10/12 or 11/12 pay plan shall accrue sick leave, vacation, and seniority during the full twelve (12) month period.

24.60 Ten (10) months or eleven (11) months of service by an employee in the 10/12 or 11/12 pay plan shall constitute one (1) year of service for employment status matters, EPI and retirement.

24.61 Approval and denial of employee requests by the President as specified in provisions 24.54 through 24.60 shall not be subject to Article 9, Grievance Procedure.